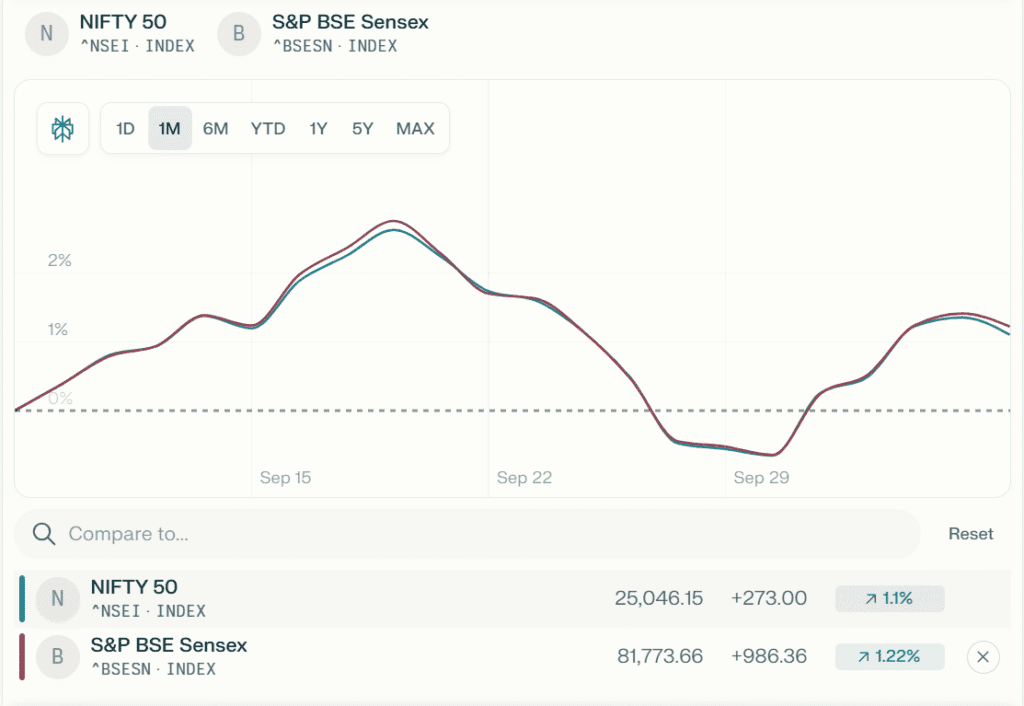

4-Day Rally Ends: Nifty Falls Below 25,100, Sensex Closes at 81,773 Points

Introduction

After a promising four-day winning streak, the Indian stock market witnessed a significant correction, with Nifty closing below the 25,100 mark at 25,046.15 and Sensex ending the day at 81,773.66 points, down by 153 points. This reversal signals a pause in the positive momentum, influenced by sector-wide profit booking and cautious market sentiment. For investors tracking nifty sensex, understanding the causes, market reactions, and what to expect next can offer critical insights for navigating volatile times.

Market Overview: What Led to the Pullback?

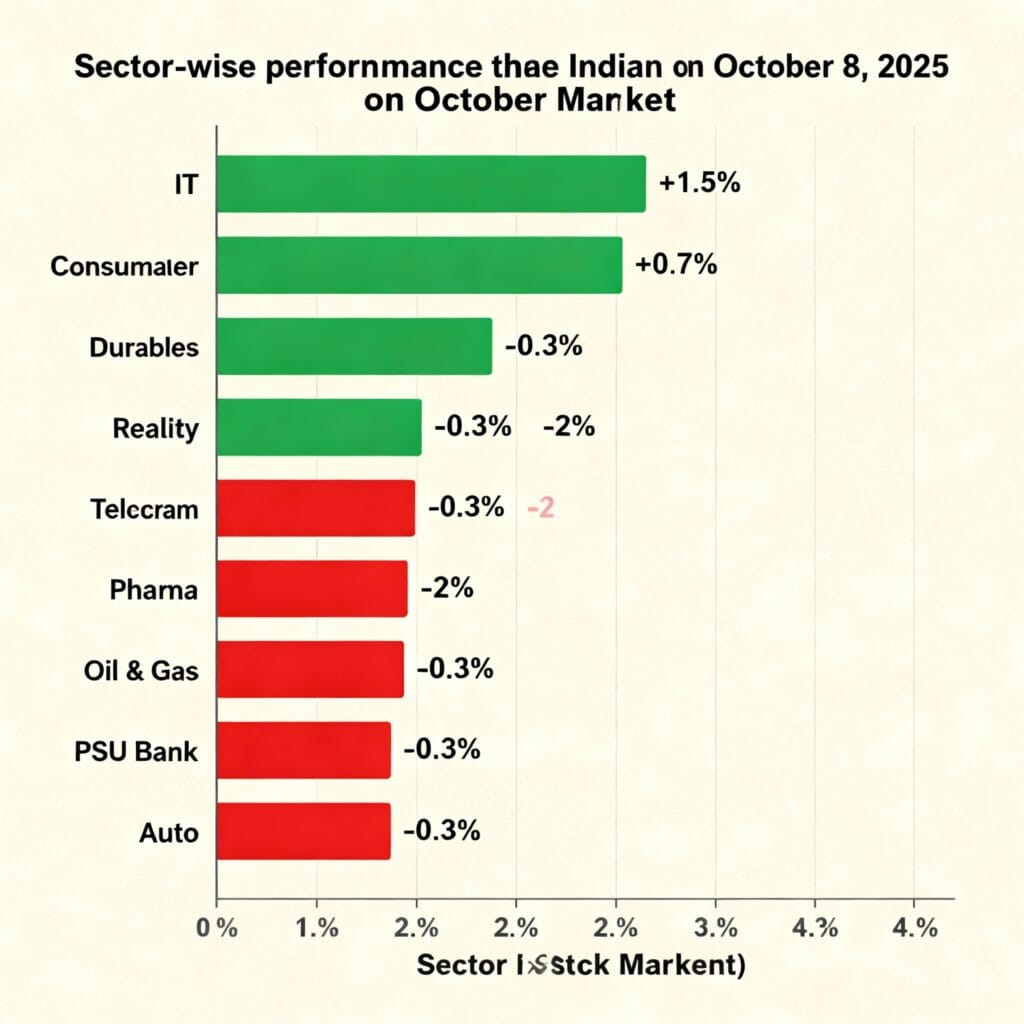

Market gains evaporated midway through trading as selling pressure intensified across major sectors:

- Except for Consumer Durables (up 0.7%) and Information Technology (up 1.5%), most sectors closed with losses.

- Realty, Telecom, Pharma, Oil & Gas, Media, PSU Banks, and Auto ended lower by 0.3% to 2%.

- Major losers on the Nifty included Tata Motors, UltraTech Cement, Jio Financial, ONGC, and NTPC.

- Strong performers included Titan Company, Infosys, TCS, Tech Mahindra, and Bharti Airtel.

Sectoral Performance Table

| Sector | Performance Today | Gain/Loss % |

|---|---|---|

| Information Technology | Gained | +1.5% |

| Consumer Durables | Gained | +0.7% |

| Realty | Declined | -0.3% – -2.0% |

| Telecom | Declined | -0.3% – -2.0% |

| Pharma | Declined | -0.3% – -2.0% |

| Oil & Gas | Declined | -0.3% – -2.0% |

| PSU Banks | Declined | -0.3% – -2.0% |

| Auto | Declined | -0.3% – -2.0% |

The Technical Breakdown

The Nifty index dropped 62.15 points or 0.25%, closing just below a crucial psychological level of 25,100. The Sensex declined approximately 0.19%, shedding 153 points. The volatile session witnessed intraday fluctuations, with Nifty touching a high near 25,220 and a low near 25,076. Such swings reflect investor caution ahead of upcoming quarterly earnings.

Chart: Nifty and Sensex Daily Movement (Last 7 Days)

Why Did the Market Pause? Key Factors

- Profit Booking After Rally: Following a fast-paced four-day rise fueled by positive corporate results and monetary policy optimism, investors took profits, especially in cyclical sectors.

- Global Cues: Mixed sentiment overseas with concerns over US government shutdown affecting risk appetite.

- Earnings Season: Upcoming Q2 earnings have set a cautious tone, with investors reassessing valuations and growth outlooks.

- Sector Rotation: Capital moved into IT and Consumer Durables, perceived as stable, while markets trimmed bets on interest-rate sensitive sectors like Realty and Banking.

Expert Opinions

Abhinav Tiwari, a research analyst at Bonanza, noted:

“Today’s market correction is a healthy pause. While selling pressure was broad, sectors like IT and consumer durables held up well. Investors are recalibrating ahead of quarterly results and global macro uncertainties.”

What Next? Market Outlook and Strategy

- Immediate support for Nifty lies near 25,000 levels. Breach below could signal further downside risks.

- Resistance levels are seen near 25,300–25,400; a rebound above this could signal recovery.

- Investors should watch global developments and RBI policy updates closely.

- Diversification across sectors and selective stock picking is advised in the current environment.

Infographic: Sector-wise Performance on October 8, 2025

Conclusion

The Nifty and Sensex correction after a strong four-day rally provides an essential reality check for investors. While profit-taking is natural, the market remains on watch for signals from corporate earnings and global economy. Understanding sectoral shifts and technical levels can help investors navigate the uncertain terrain.